The book Bank 4.0 written by famous banker Brett King had foreseen far back in 2018 that it had been the time for scenarized finance to come. Printed on the cover was the catchphrase: Banking Everywhere, Never at a Bank. During the past three years coping with COVID-19 pandemic, banks all over the world had been driven by the idea of ‘non-contact’ into exploring the new possibilities brought by scenarized finance.

This change had been more significant in developing markets such as China. Commercial Banks and Fintech Companies are actively exploring new chances to merge financial services into consumption scenarios.

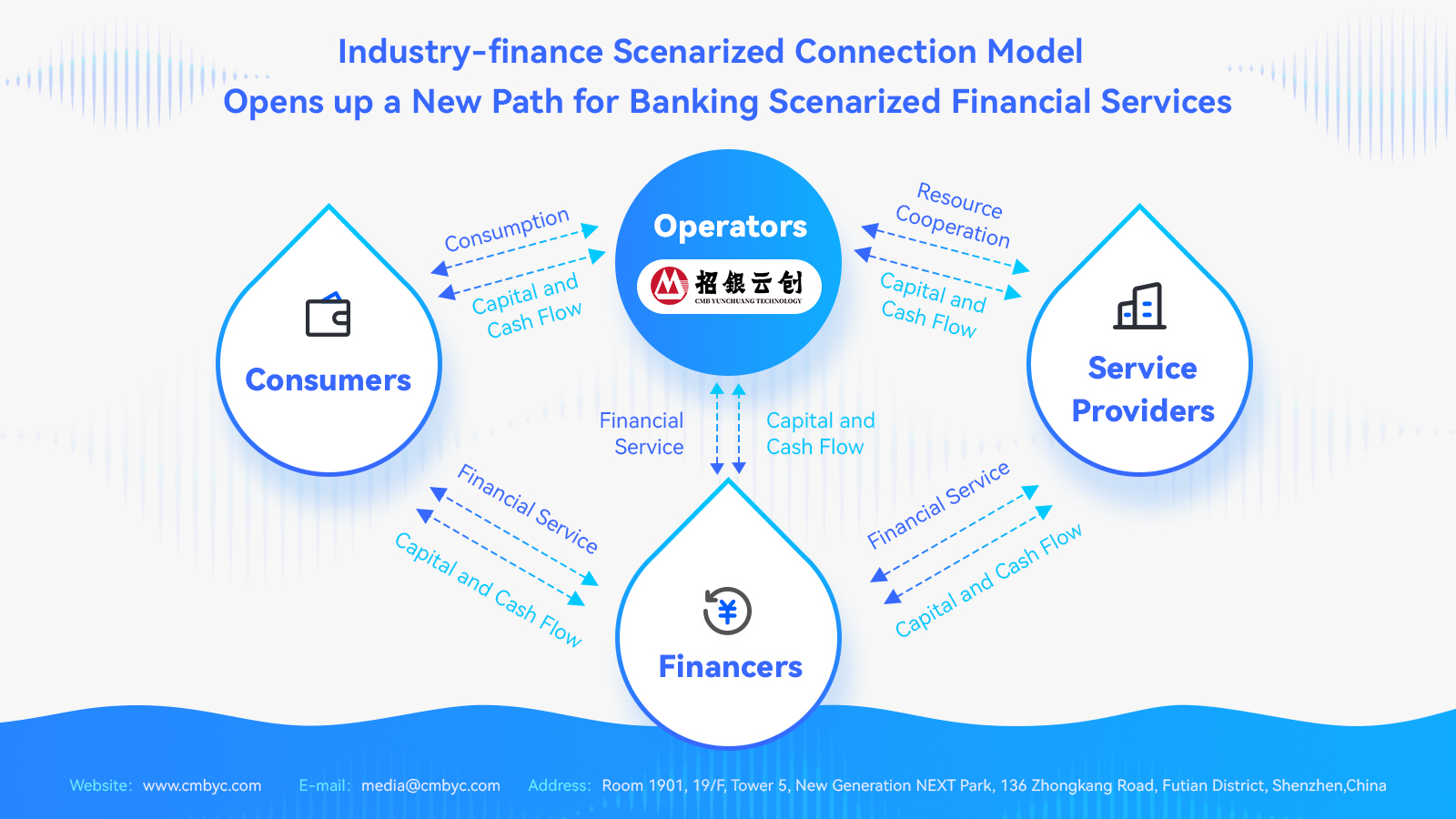

CMB YUNCHUANG Information Technology Co., Ltd. from China (also referred to as CMBYC) bridges up enterprises and financial institutions by means of scenarized finance through providing full digital solutions for capital and cash flow management. Its innovative ‘Industry-Finance Scenarized Connection’ model redefines the relationship between financial institutions and companies, providing a new Chinese solution for global bankers.

It is reported that CMBYC, located in Shenzhen, China, is a fintech subsidiary of the world-famous commercial bank, China Merchants Bank Ltd. (also referred to as CMB). On July 4, 2022, the authoritative financial media The Banker released its Top 1000 World Banks by Tier 1 2022, in which China Merchants Bank Ltd. ranked 11. This is the 5th year in a row that CMB had been listed in this ranking.

The concept of scenarized finance is actually referring to a favorably interactive ecology which incorporates financial services into consumption or industrial scenarios, providing the former to the latter and creating an efficient long-term connection. Such an ecology would include a large number of participators such as financers, operators, service providers and consumers.

CMBYC, as the founder and operator of this scenarized ecology, exerts capabilities in both capital management and professional operation, the former succeeded from CMB while the latter nurtured by the company itself. Starting with cash inflow into corporate bank accounts and ending with its outflow to downstream business partners, a whole picture of cash flow management of a firm can be drawn.

On the cash inflow side, the digital product Group Enterprise Treasury (referred to as GET) covers multiple functions for group enterprise users such as Unified Account Access Management, Central Billing Management and Financing Activity Management. On the cash outflow side, the product Scenarized Cost Control System (referred to as SCO) intergrates not only high-quality service providers in different fields such as air tickets, hotels and taxis, but also nets over 100 banks into the product by means of ERP Integration, which creates a one-stop scenarized ecological platform providing consumption service, expense management and financial services all at the same time. And then, after generating and accumulating data on cash inflow and outflow of a firm, Multiple Analysis Platform (referred to as MAP) product could perform multi-dimensional analysis on such data, in order to dig and reveal its hidden value in financing context.

In this ecological model, to provide financial services, banks only need to perform risk management based on the real transaction data generated by the enterprise customers, but no need to spend too much effort on excessive marketing or building up a transaction scenario from nothing.

Transaction scale and cash flow generation are the main indicators that banks would use to evaluate a business scenario. This Industry-Finance Scenarized Connection model designed by CMBYC covers solid high-frequency demands like corporate procurement, travel and car renting. It is stated in research reports by iResearch, a professional market research and consulting institution in China, that spending of enterprises on procurement, travel, car renting, group dining and employee benefits in total would reach a scale of several thousand billions CNY in 2022. There is full potential of generating transation and cash flow as well as banking values.

At the same time, transaction data generated from comsumption scenarios could also be used in customer portrait and demand forecast, which is additional value-adding services by CMBYC to banks assisting more accurate financial service. The closed cycle of data from cash inflow to outflow could enable banks to track the actual usage of their credit given to enterprise customers, which would further enhance risk management and credit rating capabilities.

As a fintech subsidiary in the banking circle, CMBYC’s new business model actually not only serves its parent bank CMB, but also welcomes other banks to jointly build up a broader open business ecology. This new open model will provide banks all over the world with a new path in exploring scenarized finance.

Company: CMB YUNCHUANG Information Technology Co., Ltd.

Contact Person: Mr. He

Email: hejian@cmbyc.com

Website: https://www.cmbyc.com

Telephone: 0086+400-806-7955